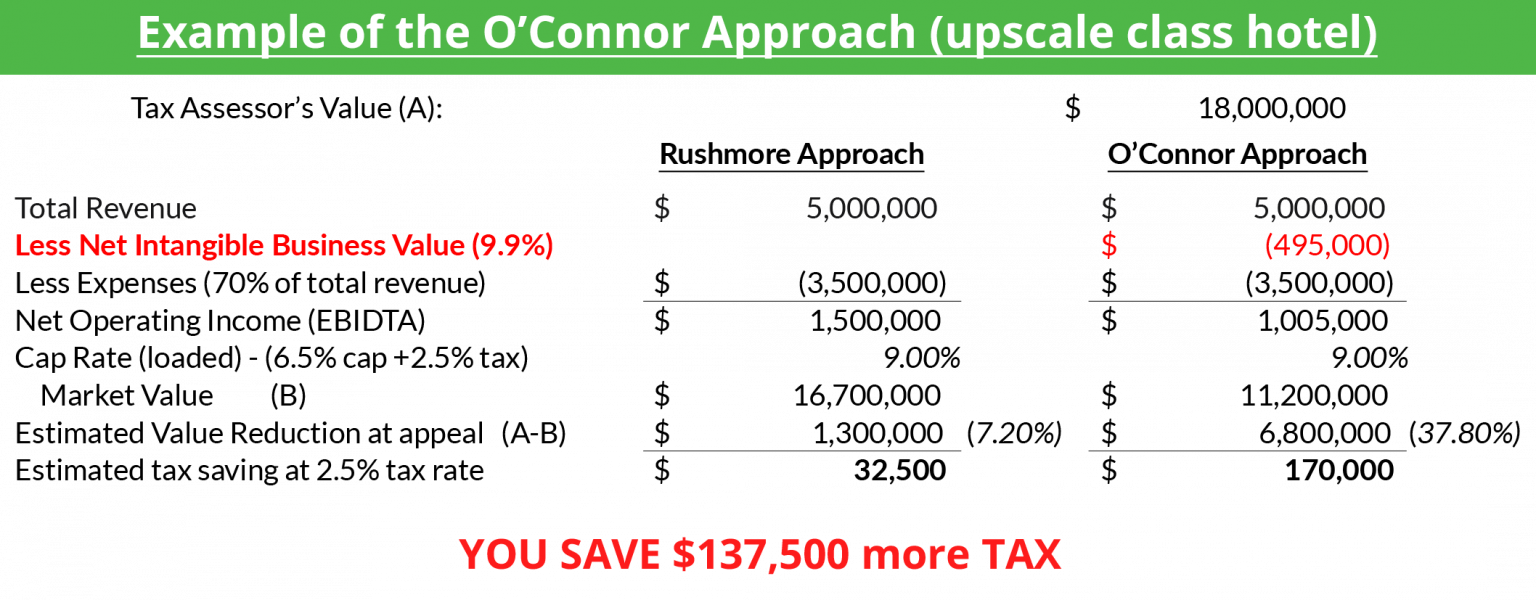

The Rushmore Approach

Property Tax Assessors have over valued hotels for years by using the Rushmore Approach to value hotels. Rushmore believes by deducting franchise and management fees paid to franchisors, it has accounted for all intangible business value from the assessment. High courts in several states disagreed. Opinions issued by courts stated that “the manner in which the property tax assessors applied the Rushmore method failed to account for economic Return on Investment because no rational investor would franchise their business to earn merely a Return of Investment. Adjustment to gross income for intangible value must be made prior to making the expense deductions.