- 2200 North Loop West, Suite 310 Houston, TX 77018

- 888-666-1876

[div id=”intro” class=”wht-bg txt-center”][row]

[/row][/div]

[clear]

[div class=”gry-bg txt-center”][row]

As the largest property tax consulting firm in the US, based on the annual number of appeals, our team saves our clients millions of dollars every year in property taxes using our proprietary O’Connor Approach©. Our staff achieves better results than is typical for most firms. We attempt to reduce your property taxes for each property every year, even if the value did not change!

Using our proprietary O’Connor approach our staff achieves better results than is typical for most firms.

We attempt to reduce your property taxes for each property every year, even if the value did not change!

[/row][/div]

[clear]

[div id=”benefits-how-works” class=”whtbg txt-center”][row]

![]()

First we seek to understand the client’s needs and magnitude of tax pain and review properties available for cost segregation.

![]()

O’Connor works closely with you and/or your CPA or financial/tax manager to collect existing data and documents regarding the subject property.

![]()

An appraiser inspects the property to identify eligible items, then calculates their value and allocates each to its correct depreciation life, per IRS rules and Federal Tax Courts decisions.

[clear]

[div class=”what-makes-oconnor”][row]

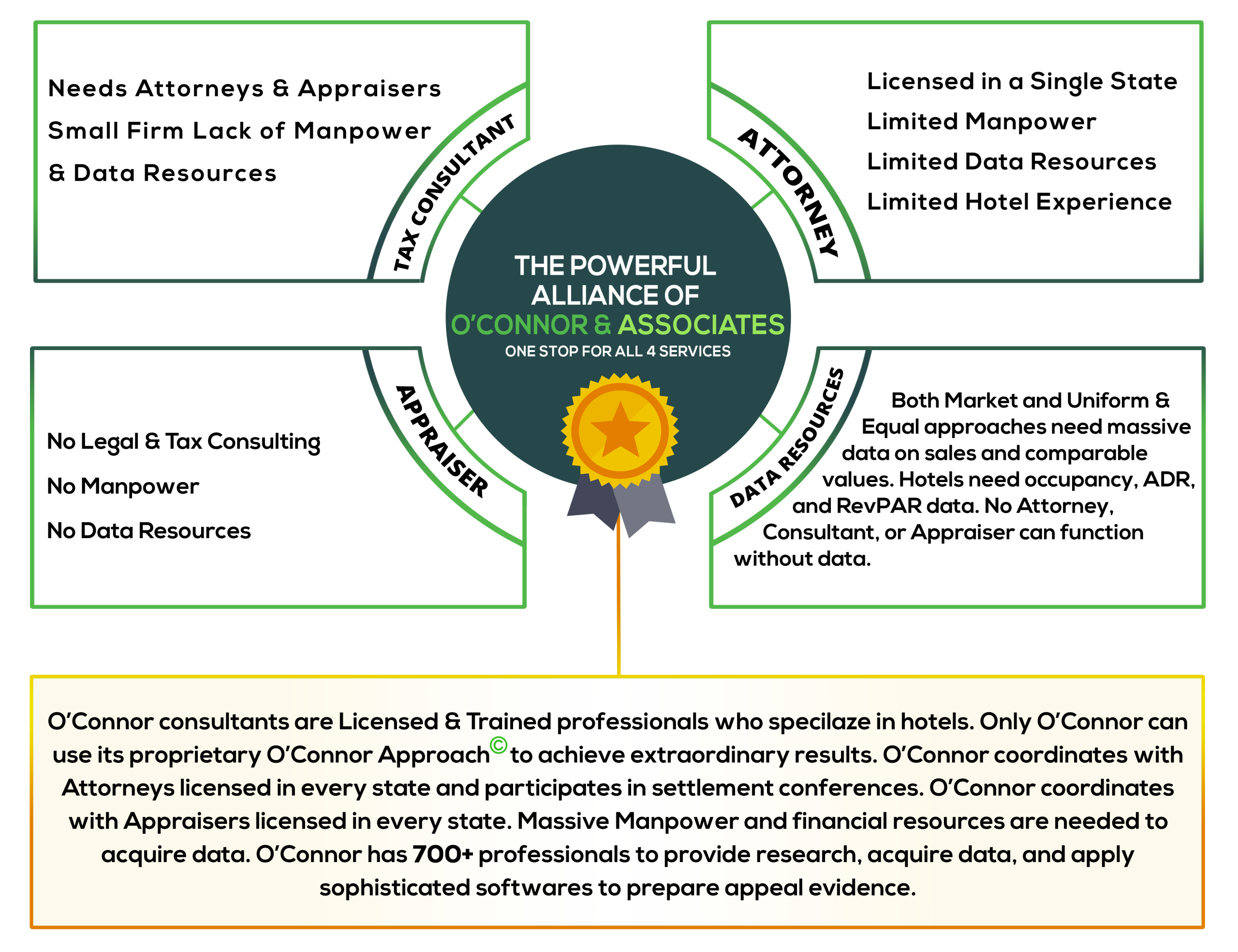

The valuation of lodging facilities is a highly specialized art and is one of the most challenging tasks for tax assessors as well as property tax consultants or attorneys. A lot of Hotel’s value lies in its flag, which is intangible and is exempt from Ad Valorem Taxation in every state. The problem is no one knows how to calculate intangible business value of a hotel’s flag.

[/row][/div]

[clear]

[div id=”rushmore-approach” class=”rushmore-approach txt-center”][row]

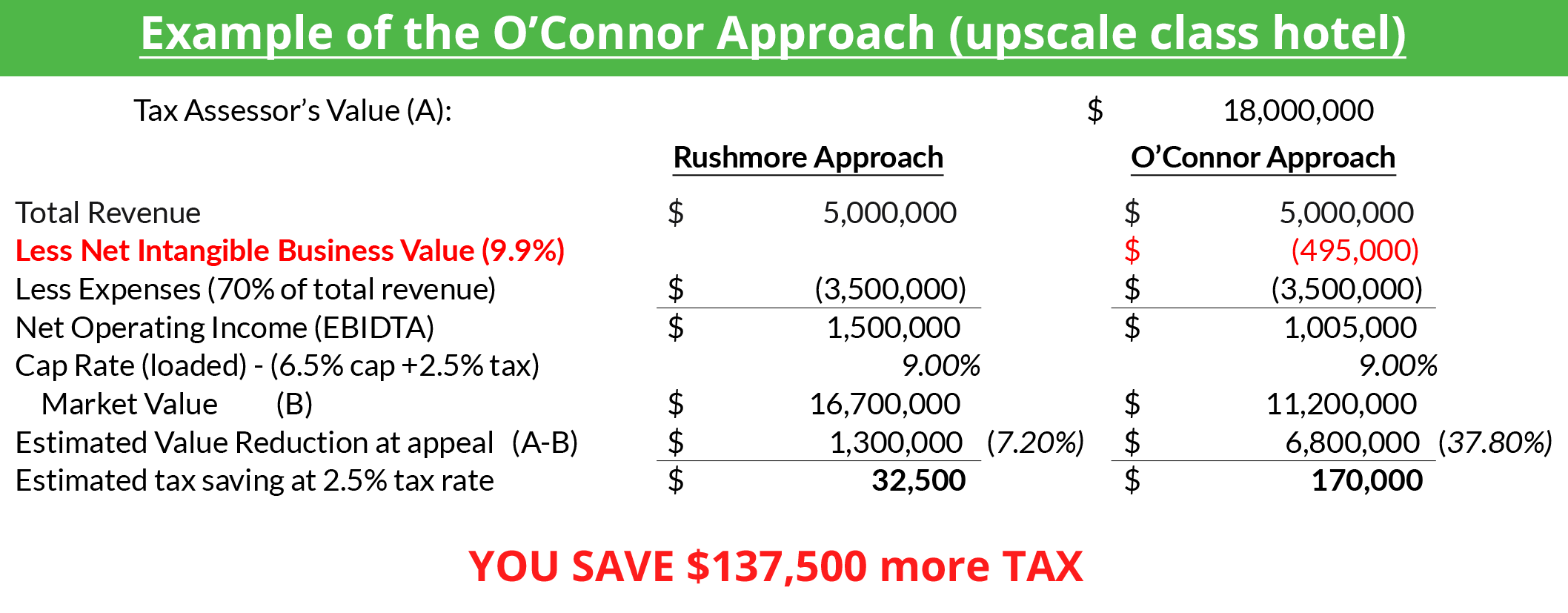

Tax Assessors have over valued hotels for years by using the Rushmore Approach to value hotels. Rushmore believes by deducting franchise and management fees paid to franchisors, it has accounted for all intangible business value from the assessment. High courts in several states disagreed. Opinions issued by courts stated that “the manner in which the tax assessors applied the Rushmore method failed to account for economic Return on Investment because no rational investor would franchise their business to earn merely a Return of Investment. Adjustment to gross income for intangible value must be made prior to making the expense deductions.

[/row][/div]

[div id=”” class=”oconnor-approach txt-center”][row]

O’Connor acquires and collects ADR, Occupancy, RevPAR and Franchise Fees data from major publications, hotel associations and franchisors from every region. The incremental increase in revenue associated with the flag is electronically calculated. After deducting franchise fees, the Net Gain is intangible business value to be deducted from revenue to lower property taxes. The O’Connor Approach is copyright protected, used exclusively by O’Connor.

The O’Connor Approach is a game-changer for the Hotel Industry

[/row][/div]

[clear]

[div id=”grn-two-cols” class=”wht-bg withgrn-cols”][row]

If evidence supports further reductions after the BOE hearing, we continue the protest by coordinating a lawsuit against the appraisal district – on a contingency fee basis, up until the trial phase. We will engage legal counsel and order appraisal reports, if necessary, at no cost – unless the tax is reduced or a tax refund is achieved by O’Connor. If owner rejects all settlement offers and elects to pursue a court trial, O’Connor will provide owner an estimate of costs associated with a trial prior to incurring any trial phase related expenses.

Tax laws allow owners to appeal assessments based on equality with similar properties. We are the nationwide leader in presenting sophisticated analysis supporting favorably assessed comparable, in addition to market value arguments. With a process for compiling and analyzing data for uniform and equal analysis, value reductions were achieved 69 percent of the time for commercial properties.

Our tax team achieve a higher percentage reduction than other consultants. They are the nationwide leader in presenting Appraisal Review Board or Board of Equalization with sophisticated analyses supporting aggressive values.

With O’Connor, no fees are due unless the property taxes are reduced. For states where property values are reassessed every year, fees are applicable for the protested year only. In fact, our team will continue to protest each year, billing only when savings are achieved. Multi-year fees may apply if owner benefited from tax savings for multiple years in states where tax reduction is frozen in subsequent year(s).

[/row][/div]

[clear]

[div class=”enrolltoday”][row]

Your property taxes will be aggressively protested every year by the #1 property tax firm in the country. If your taxes are not reduced you PAY NOTHING, and a portion of the tax savings is the only fee you pay when your taxes are reduced! Many FREE benefits come with enrollment.

[clear]

[div class=”wht-bg withgrn-cols txt-center”][row]

A commercial real estate appraisal is a complex undertaking. Our knowledgeable appraisers gather and analyze data

to make informed decisions about real estate values. Our team leverages best practice analytical techniques,

including cost, income and sales comparison approaches based on the characteristics of each property.

[clear]

is considered most applicable for commercial real estate appraisals for relatively new properties and special-use properties.

Commercial real estate appraisers are less likely to use the cost approach for older properties due to the difficulty of precisely calculating the amount of depreciation.

is most applicable for investment or income properties. Appraisers gather data regarding the actual income and expenses for the subject property, rental comparables, expense comparables, industry expense data, market occupancy, and rental market trends for analysis.

The commercial real estate appraiser then estimates gross potential income, other income, effective gross income, operating expenses, and net operating income to arrive at a value conclusion.

Commercial real estate appraisers also utilize the sales comparison approach to determine market value. The sales comparison approach is often utilized on owner-occupied properties.

After obtaining data regarding similar properties that recently sold, the appraiser applies appropriate adjustments to the comparable sales to form an opinion of market value for the subject property.

To obtain a quote or additional information for a Commercial Real Estate Appraisal, contact John Fisher

at 713-375-4297, 1-800-856-7325 x 4297, or fill out our online form.

[/row][/div]

[clear]

[div class=”enrolltoday”][row]

Your property taxes will be aggressively protested every year by the #1 property tax firm in the country. If your taxes are not reduced you PAY NOTHING, and a portion of the tax savings is the only fee you pay when your taxes are reduced! Many FREE benefits come with enrollment.